SVB Securities raised Tengshengbo Pharmaceutical (2137.HK) expectations to target price of HK$19 per share

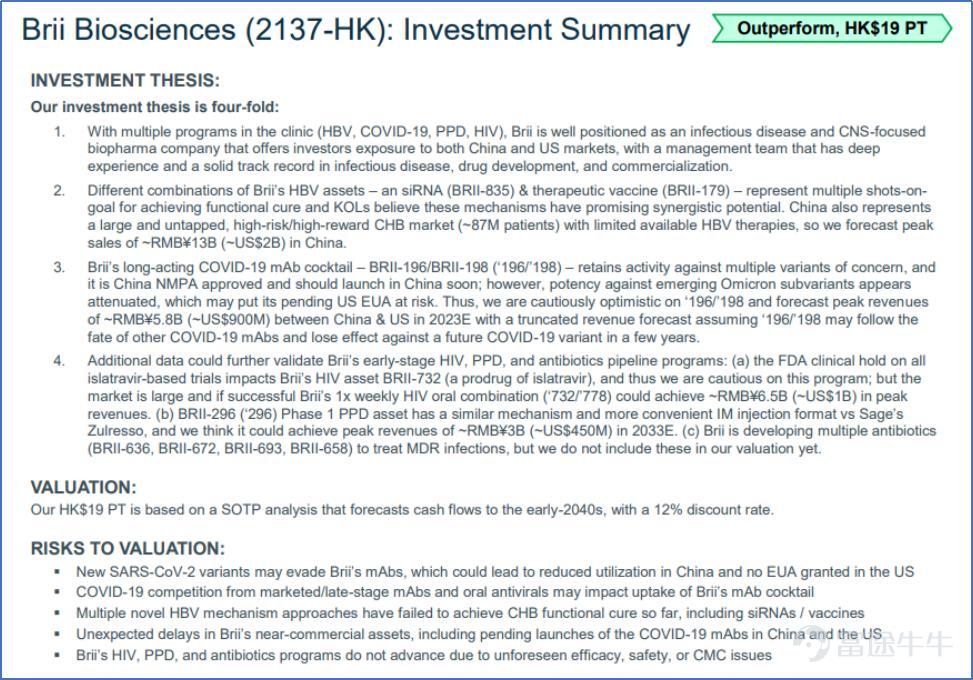

SVB Securities recently raised $BRII-B(02137.HK$ The target price is expected to reach HK$19 per share. SVB's investment arguments are mainly based on the following four aspects: (1) Brii has multiple important clinical projects (HBV, COVID-19, PPD, HIV), the company is positioned by the market as a key biopharmaceutical company with infectious diseases and central nervous system, and has experienced management and drug development management teams. (2) Brii's functional therapeutic combination therapy for hepatitis B — siRNA (BRII-835) and therapeutic vaccine (BRII-179) — is expected to achieve breakthroughs in this field, and some KOLs believe that the mechanisms of these combination therapies have potential for synergy. China is the largest chronic hepatitis B market in the world, with around 87 million patients awaiting treatment, so we forecast a peak revenue of ~RMB¥13 billion. (3) BRIi's long-acting COVID-19 monoclonal antibody against COVID-19 — BRII-196/BRII-198 The estimated peak revenue is ~RMB¥5.8 billion. (4) More clinical data confirm BRII's future expectations for HIV and postpartum depression (PPD) and antibiotics: BRII-732/778, which is administered once a week for HIV, may have a potential peak sales of ~RMB¥6.5 billion, and the potential peak sales of BRII-296 for postpartum depression is about ~RMB¥3 billion. Brii also has the most promising next generation antibiotic combination (BRII-636, BRII-672, BRII-693, BRII-658) to treat multiple drug-resistant (MDR) bacterial infections, but we are not including these early development projects in the estimate for the time being.

The report cites some positive opinions from experts on the company's combination of therapies to enhance the company's pioneering concept design on the hepatitis B functional cure circuit and expectations of multiple clinical trials.

Key future share price catalysts worth watching include: (1) FDA's decision on the EUA to apply for '196/' 198 COVID-19 mAb in 2022; (2) more data from the BRII-835/PEG-IFN-α phase II chronic hepatitis B joint trial; (3) BRII-179/BRII-835 phase II chronic hepatitis B joint trial study (if the data is positive, the company will submit IND to China's CDE for key research in 2023); (4) from the FDA's decision to apply for' 196/' 198 mAb in 2022; (4) from the BRII-835/PEG-IFN-α phase II joint trial March trial data from 3434 to evaluate the introduction plan for this neutralizing antibody; (5) completing the BRII-296 phase I clinical trial for PPD and sharing results at 2H22; (6) phase 1 data for HIV assets BRII-778 and BRII-732; (7) the enrollment and interim top line results for the phase 2a portion (n = 120) of the BRII-179/PEG-IFN-α phase II chronic hepatitis B combination trial, which is expected to be completed in 2H22.

In the current competitive landscape of COVID-19, SVB believes that the COVID-19 field is not a zero-sum game; there should be enough space to accommodate multiple market participants. §Due to the dosing/durability advantage of small-molecule oral antiviral drugs, monoclonal antibodies can still be used as second-line treatment in outpatient treatment; however, antiviral drugs are not an appropriate choice (contraindications, etc.) for some specific patients, so neutralizing antibodies can still find a stable competitive advantage. Furthermore, the company's ambavirumab and romisuvir monoclonal combination therapy maintained neutralizing activity against the major COVID-19 variants that have received widespread attention, including the latest popular variants B.1.1.529-BA.1 (Omicron, Omicron), and BA.1.1 and BA.2 (Omicron subtype variants), which further highlights the company's antibody competitiveness.

Risk Disclaimer: The above content only represents the author's view. It does not represent any position or investment advice of Futu. Futu makes no representation or warranty.

Read more

Comment

Sign in to view/post comments