Seize the major opportunities of the future

On November 17, Beijing time, Hongcheng Environmental Technology (HK.2265) surged 22.09% to a new high since listing. At the close of trading, it was reported at HK$1.05, with a turnover exceeding HK$30 million and a total market capitalization exceeding HK$1.05 billion. Trading volume continues to expand, and market participants are actively trading.

Earlier, the company (HK2265) announced the prospectus results on November 11 and issued 250 million shares at a price of 1.02 yuan per share. The shares were successfully listed on November 12. The Company received a total of 11,662 valid applications in the Hong Kong public sale section, which oversubscribed by 23.26 times.

This year is the first year the “double carbon” target was launched. As a leading domestic gold mine hazardous waste treatment company, the company focuses on treating hazardous waste from gold mines and recovering and extracting economically valuable resources from it for sale, which is highly in line with the current development trend of the environmental protection industry.

Currently, as gold mine solid waste treatment output continues to increase and environmental protection requirements become more stringent, the market is still growing rapidly.

According to the Frost & Sullivan report, the compound annual growth rate of hazardous waste treatment markets in China and Shandong gold mines will be 19.1% and 17.8% respectively in 2020-2025, and will reach 4,569 billion yuan and 2,921 billion yuan respectively by 2025. In the future, along with the industry's growth rate, the company's value advantage will be further highlighted.

According to the 2020 processing scale, the company ranked first in Shandong Province and China. The actual processing capacity was about 1.08 million tons, accounting for about 26% and 18% of the total actual processing volume of Shandong Province and China in 2020, respectively.

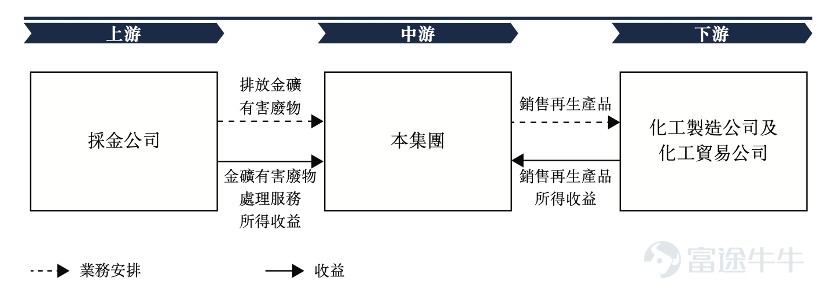

The company's core business model is mainly divided into two parts:

The first is to provide hazardous waste treatment services for upstream gold producers;

Second, economically valuable resources such as sulfur concentrate and gold-sulfur concentrate are recovered from hazardous waste and sold to downstream chemical plants and related trading companies.

Second, economically valuable resources such as sulfur concentrate and gold-sulfur concentrate are recovered from hazardous waste and sold to downstream chemical plants and related trading companies.

Investors can read the relevant prospectus and find that in the past three years, these two core businesses accounted for about 96.5%, 88.3%, and 92.8% of total revenue.The main business focus is outstanding.

Meanwhile, in 2018-2020, the company generated revenue of 102 million yuan (RMB, same unit), 134 million yuan, and 205 million yuan, with a compound annual growth rate of 41.7%; net profit to mother was about 30.7 million yuan, 48.48 million yuan, and 72.86 million yuan respectively, with a compound annual growth rate of 54.1%; profitability increased dramatically.

It is worth noting that the return on net assets (ROE) for the past three years was 171.6%, 73.0%, and 68.7%, respectively, and the overall operation of the company was strong. With the gradual implementation of the company's fund-raising projects, it is expected that in the next 2 to 3 years, the scale and efficiency of the company's business will further increase, and the return on equity (return on net assets ROE) is expected to maintain a high level and be sustainable.

According to Wind data, the average ROE of the A-share environmental engineering industry is only 12%. It can be seen that the company's profitability far exceeds that of its market peers. Also according to Wind data, the average gross margin of the A-share environmental engineering industry is 32%, while the company's gross margin in the past two years has reached more than 60%, and the net profit margin is above 30%. As an industry leader, the company still has opportunities to rise in the future.

In August of this year, the company was recognized as a “specialized, special and new” small and medium-sized enterprise by the Shandong Department of Industry and Information Technology.

The company plans to use about 86.7% of the proceeds from capital raising to increase production capacity and strength to strengthen its market position; about 3.9% will be used to strengthen the company's R&D capabilities; and about 9.4% will be used as general working capital.

Thanks to the above factors, the company's management team has made concerted efforts and looks forward to rewarding investors with better performance in the future and opening a new chapter in a new round of development. The company will seize the opportunities of the times and work with investors to create a beautiful vision of an environmentally friendly lifestyle.

Risk Disclaimer: The above content only represents the author's view. It does not represent any position or investment advice of Futu. Futu makes no representation or warranty.

Read more

Comment

Sign in to view/post comments