For the consecutive month with sales of 0.05 million, stepping into a new era of electric cars, Tesla's "First Principles" approach mitigates supply challenges.

Recently, the China Association of Automobile Manufacturers (CAAM) released data on Chinese automobile sales, showing that in October, Tesla's wholesale sales volume once again exceeded 0.05 million units, reaching a dazzling 54,391 units, a year-on-year increase of 245%. It is clear that Tesla has steadily entered the monthly sales of 0.05 million level. Tesla's continuous breakthroughs have brought new imaginations and practical experiences to China's new energy auto industry.

At the same time, Shanghai, serving as a global export center, has once again expanded its efforts. In October, Tesla's export volume exceeded 0.04 million units for the first time, setting a new high for China's new energy vehicle exports. Particularly noteworthy, Tesla's export volume from China has reached nearly 0.15 million units so far in 2021, making it an important member of China's manufacturing 'going global' strategy.

Export organic growth leads the new track of electric vehicles.

Export organic growth leads the new track of electric vehicles.

According to research firm JATO Dynamics data, in September, the Tesla Model 3's European registration volume reached 24,591 units, surpassing traditional fuel vehicles like Renault and Volkswagen, winning the top spot in European car sales and becoming the first new energy vehicle to defeat traditional fuel vehicles in the monthly European rankings.

If Tesla's dominance in European sales represents people's acceptance and admiration for electric travel, then Tesla's 'high-priced hot sale' on the other side of the ocean must be said to be the triumph of a brand new driving experience empowered by technology. The Singapore government imposes high taxes on imported cars, and the price of the Tesla Model 3 standard long-range upgrade version in Singapore is as high as nearly 0.2 million Singapore dollars, equivalent to 0.95 million Chinese yuan. This price is nearly 4 times that of the American market, but the high price still cannot stop consumers' favor for Tesla. According to statistics from the Singapore Land Transport Authority, as of the end of the third quarter, Tesla's car ownership in Singapore has increased 15 times compared to the first half of this year.

In addition, according to data from the Korea Automobile Importers & Distributors Association and the Korea Automobile Research Institute, Tesla's sales in the first half of this year reached 0.0116 million units, a year-on-year increase of 64.3%. Most remarkably, Tesla has accounted for over 80% of the total sales of imported electric vehicles in South Korea in the first half of the year.

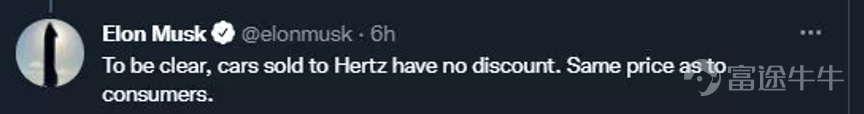

Not only making great strides in the passenger vehicle market, Tesla has also achieved remarkable results in the car rental market. The well-known North American car rental brand, Hertz, placed an order for 0.1 million Tesla Model 3 vehicles without any discounts, with an order amount of 4.2 billion U.S. dollars, equivalent to 26.8 billion Chinese yuan. Hertz's large-scale order of Tesla Model 3 is not only due to Tesla's excellent product reputation in the North American market, which can bring a huge customer cohort, but also based on considerations such as the significantly lower post-use costs for Tesla in terms of repair and maintenance compared to fuel vehicles.

Tesla's sales continue to rise steadily, with stable output for several consecutive months, not only performing well in the domestic market but also gaining more and more favor from overseas consumers. This is closely related to its outstanding product strength and comprehensive product quality control throughout its lifecycle. Whether in terms of range, handling performance, or technology such as automatic driving assistance, Tesla is a performance leader in pure electric vehicles. Moreover, Tesla prioritizes safety from the initial design, continuously enhancing its safety performance throughout the entire lifecycle including production, smart protection, etc., providing consumers with a high-performance and safer product experience.

"First principles" open up new solutions to the supply chain.

In the post-pandemic era, the global automotive industry supply chain has suffered significant impacts, especially with chip shortages becoming a persistent 'pain' for most automakers. According to the research institution AutoForecast Solutions, as of the end of September, chip shortages have led to a cumulative production reduction of 8.934 million vehicles in the global automotive market, with China's cumulative production reduction reaching 1.814 million vehicles, accounting for 20.3% of the total. Recently, the automotive industry has even seen individual car companies engaging in 'magical' practices such as purchasing inventory chips at high prices.

"First principles" open up new solutions to the supply chain.

In the post-pandemic era, the global automotive industry supply chain has suffered significant impacts, especially with chip shortages becoming a persistent 'pain' for most automakers. According to the research institution AutoForecast Solutions, as of the end of September, chip shortages have led to a cumulative production reduction of 8.934 million vehicles in the global automotive market, with China's cumulative production reduction reaching 1.814 million vehicles, accounting for 20.3% of the total. Recently, the automotive industry has even seen individual car companies engaging in 'magical' practices such as purchasing inventory chips at high prices.

However, while the entire industry is struggling with declining sales due to supply chain shortages, Tesla has steadily climbed in production and sales performance, steadily entering the level of monthly sales of 0.05 million units, once again demonstrating the power of its acclaimed 'first principles' which involve 'seeing the essence of things, breaking them down to the most basic components, and solving problems at the source'. It is understood that Tesla, from the perspective of efficient production, safe driving, excellent experience, and more, has creatively addressed the supply chain challenges by enhancing its global supply chain vertical integration capabilities and technology reserves, including in-house chip capabilities.

Recently, Morgan Stanley's chief analyst Adam Jonas issued a report stating, 'Tesla may be the OEM manufacturer with the highest degree of global vertical integration, hence Tesla is able to understand the status of the supply chain earlier and adopt multiple suppliers to ensure supply.' The report also points out that Tesla's uniform pricing objectively avoids channel premiums.

As Tesla CEO Musk said, 'I am an engineer, besides cars, I am also very fascinated by supply chains, logistics, and production processes.' When Tesla felt the pressure on the supply chain as early as the first quarter of this year, Tesla had already begun integrating supply chain resources to address issues such as chip shortages. Therefore, Tesla had the confidence to write in the second-quarter financial report, 'Although semiconductor supply shortages persist, we can further increase production.'

In addition, Tesla's unique in-house chipset, advanced R&D capabilities, and technical reserves are another major weapon that enables Tesla to break through the supply chain dilemma. The supercomputer Dojo and the in-house D1 chip unveiled by Tesla at the AI Day in August allowed the world to once again feel Tesla's absolute technological advantage, while software perfectly complementing hardware further helped Tesla alleviate the threat of chip supply shortages. Volkswagen CEO Herbert Diess publicly praised Tesla's approach of 'developing new controllers to solve chip shortages' at a recent executive meeting.

Musk once said, 'If I don't invest myself fully, that's the biggest risk, because the hope of success is zero.' Tesla can find breakthroughs in the challenges faced by the global industry, always taking 'accelerating the world's transition to sustainable energy' as its mission and continuously moving towards its goals under the guidance of 'first principles'. This is likely the Tesla success formula that the world has been pondering about.

Risk Disclaimer: The above content only represents the author's view. It does not represent any position or investment advice of Futu. Futu makes no representation or warranty.

Read more

Comment

Sign in to view/post comments